Why JP Morgan is bearish on Mr Market in 2024

Go to cash and bonds for the first half of 2024, says Marko Kolanovic.

Markets were fairly disconnected from the economy in 2023, says JP Morgan in its 2024 Outlook.

This year, we saw the largest and fastest interest rate hikes in history, a regional banking collapse, major wars, energy crisis and recession in the Eurozone core.

This did not stop the S&P 500 from rallying almost 20% in 2023.

Which is to say, you could have predicted the hikes, the banking collapse, and the Eurozone core recession in 2023 — making you some kind of Cassandra with a crystal ball — and still forecast the 2023 market direction wrongly!

Which just goes to show — markets are not the economy.

I should probably add, JPM was largely wrong on the equity market this year. But that’s 2023.

We’re now looking at their 2024 outlook.

Why JPM is predicting a weak Mr Market for 2024

The US consumer is under increasing credit stress

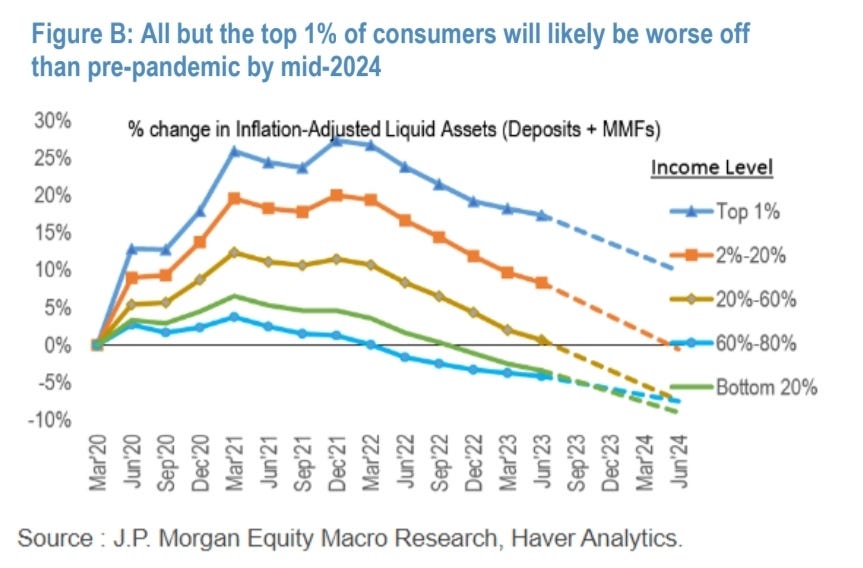

For 80% of US consumers (who account for 2/3 of US consumption), excess savings from the Covid era are gone.

According to the chart below, only the top 1% of households will be better off than before the pandemic, by mid-2024.

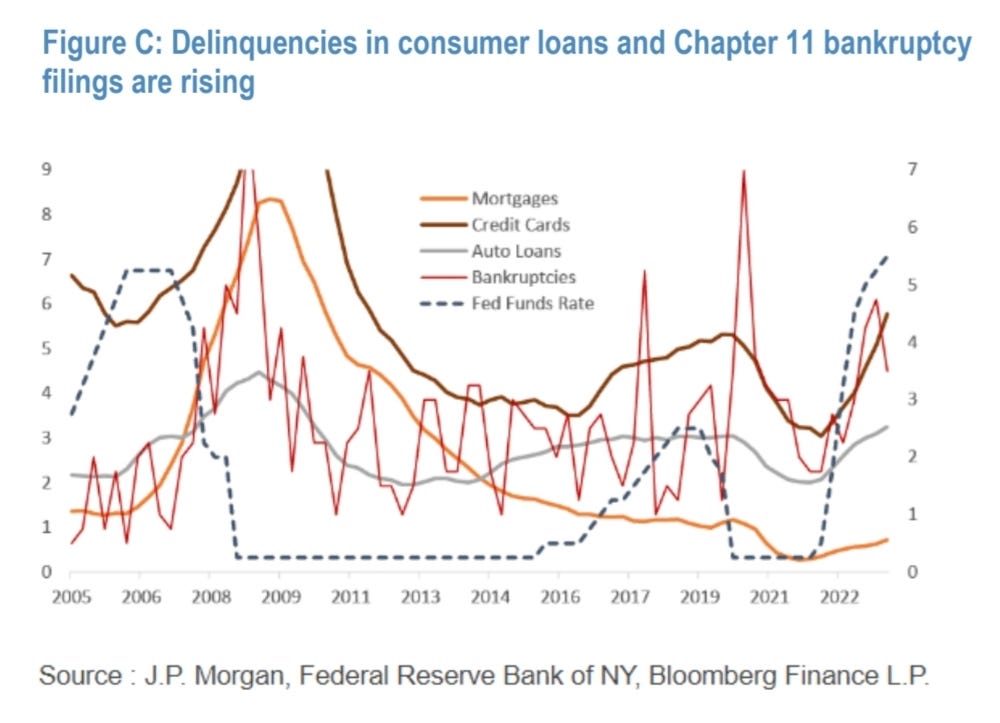

The next chart shows the increasing stress in credit card and loan delinquencies, as well as Chapter 11 filings.

Decline in inflation and economic demand

Will investors welcome the decline in inflation in 2024, and drive up stock prices?

JPM thinks otherwise.

JPM thinks that the decline in inflation and economic demand in 2024, will cause investors to worry a bit, and maybe even panic.

TERMS OF USE: Some of the information on this website may have changed since the time of writing. By continuing to read this article, you agree to be bound by our Terms of Use and Disclaimer and verify any information before taking action. Stay safe!

Legal disclaimer: This content is for informational purposes only. You should not construe such information as material for financial, legal, investment or tax advice. Views and opinions expressed by Pugs&Pennies are personal and not meant to constitute advice. In exchange for using this site, you agree not to hold Pugs&Pennies liable for any claims of damages upon decisions you make after visiting this site.

Why Goldman Sachs is bullish on stocks

Almost every major strategist expects a recession in 2024. All except Goldman. Let's examine Goldman's breath of fresh air. Goldman predicts no recession in 2024 — the only major bank with this outside-the-box view In Goldman's view, rapidly rising interest rates have only reduced