Morgan Stanley: 15 Ways to Play the AI Trade

Feeling FOMO over Nvidia? What is a reasonable play on the AI trade?

Mr Market’s record high rally year to date has been hard carried by six stocks.

Much of the gains in the S&P 500 since Jan 2024 have been due to Nvidia, Eli Lilly, Meta, Google, Apple and Broadcom.

In other words, just two themes — Artificial Intelligence and Obesity Drugs.

Do note that I am not recommending you to buy these stocks at this time, but to consider how to play the long-term AI trend in different stages and in different ways. With the prospect of Fed rate cuts keeping market volatility low, you may not get the correction you wish for.

Best way to invest in AI #1: Individual Stocks

“It will not be long before companies adopting this technology start to outperform their peers, and it will not be easy to tell why from the outside.”

Sam Altman, March 2024

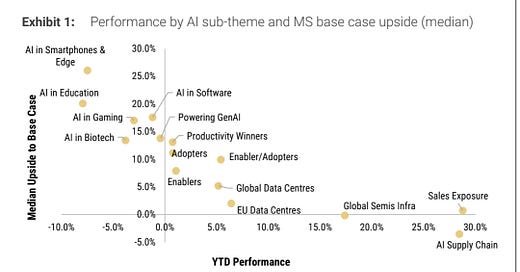

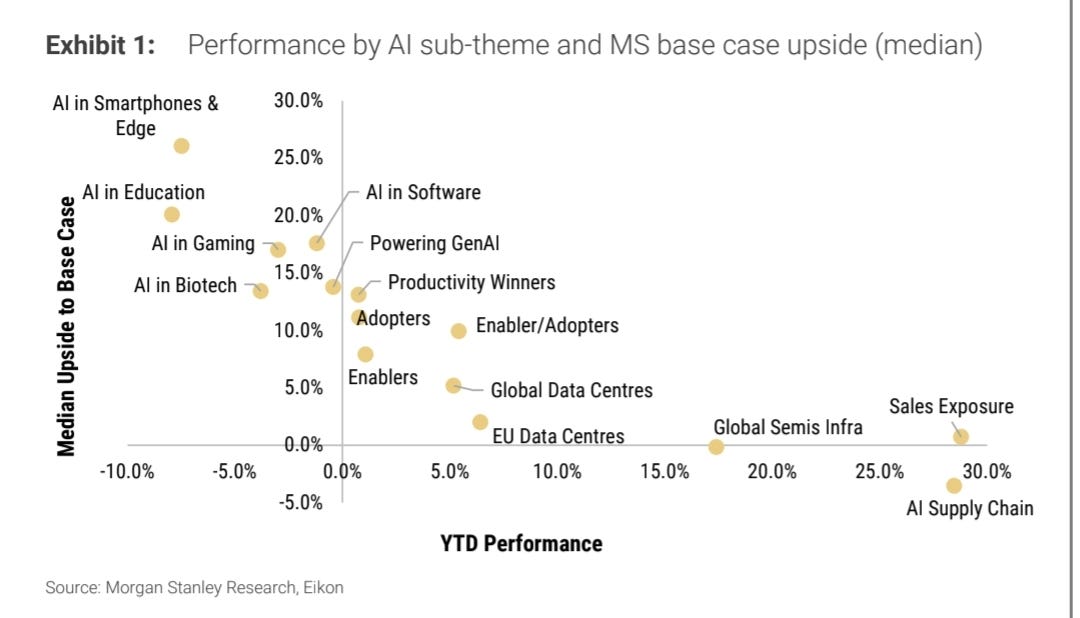

Morgan Stanley has released a paper called “15 Ways to Play AI” in March 2024.

The US AI trade has been narrow, confined to mostly 5 Mega Tech stocks — 2 of the hottest are in Global Semiconductors (other than TSMC and ASML) in the initial AI infrastructure buildup phase of the multi-stage AI revolution.

MS has picked out 480 stocks listed in the 15 sub-themes under a broadening AI regime, with 8 stocks appearing in 4 sub-themes or more.

TERMS OF USE: Some of the information on this website may have changed since the time of writing. By continuing to read this article, you agree to be bound by our Terms of Use and Disclaimer and verify any information before taking action.

LEGAL DISCLAIMER: This content is for informational purposes only. You should not construe such information as material for financial, legal, investment or tax advice. Views and opinions expressed by The Family Investor are personal and not meant to constitute advice. In exchange for using this site, you agree not to hold The Family Investor liable for any claims of damages upon decisions you make after visiting this site.