Goldman Sachs: How the S&P 500 can go higher from here

Their upside scenario vs. the current market.

Goldman Sachs has raised its year-end forecast for the S&P 500 to 5,600. That's just a small bump upwards from the current market. Nothing worth looking at.

What's interesting is their upside scenario of 6,300 (+16%). This is a lower possibility event compared to their main forecast of 5,600.

Goldman thinks it's worth considering how we could get to 6,300. Especially now as bears come out to play again, and US earnings season comes round. With a slight lowering in earnings expectations, it is likely that Big Tech will continue to beat on the upside earnings-wise.

While the concentration of the US market in 3 mega stocks driving most gains is worrying, let's look at their argument to keep an open mind.

Caveat: GS trading desk is recommending clients to put shorts on Middle class consumer stocks.

How we go higher #1: Broader SPX index “catches up” with Big Tech

If gains widen to include the rest of the S&P 500 index, so that the equal weight index trades at their pre-pandemic 2018 high of 18x, the S&P 500 would end the year at 5,900.

How we go higher #2: Megacap exceptionalism continues

Two assumptions prevail in the upside scenario.

The equal-weight S&P 500 trades at 16x PE.

The cap-weight S&P 500 trades at a 45% premium to the equal-weight index. This would take the aggregate S&P 500 to a forward PE of 23x, or 6,300.

In this scenario, there is further upside of 16%.

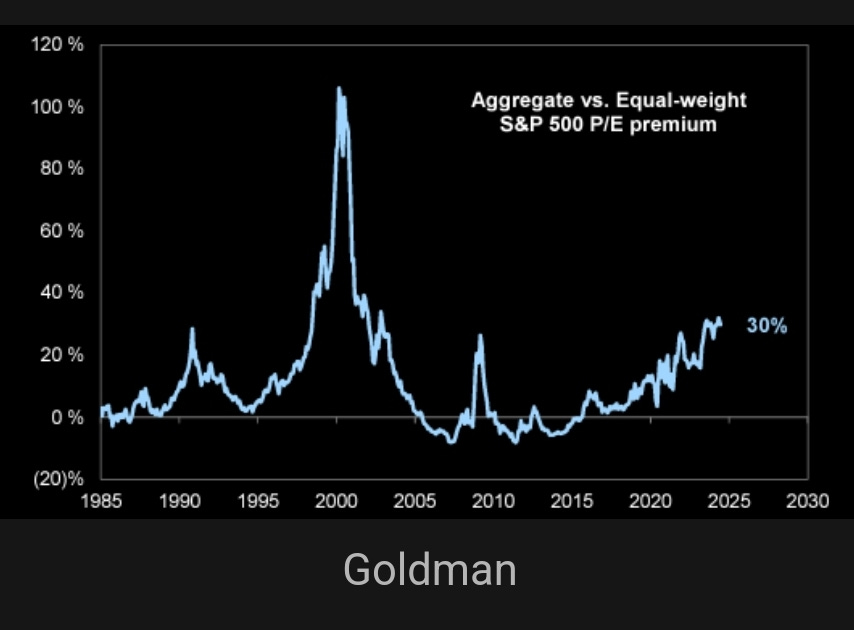

While a 45% valuation premium sounds high, it is in the 89th percentile of returns. As the chart below shows, we are currently at a 30% premium.

What is driving new all-time highs in the S&P 500 and how high can we go?

It's no secret.

TERMS OF USE: Some of the information on this website may have changed since the time of writing. By continuing to read this article, you agree to be bound by our Terms of Use and Disclaimer and verify any information before taking action.

LEGAL DISCLAIMER: This content is for informational purposes only. You should not construe such information as material for financial, legal, investment or tax advice. Views and opinions expressed by The Family Investor are personal and not meant to constitute advice. In exchange for using this site, you agree not to hold The Family Investor liable for any claims of damages upon decisions you make after visiting this site.